The Corporate Finance & Capital Markets team supports the conceptualisation and launch of investment vehicles

Launching new investment vehicles is difficult in the current environment. However, good ideas with an attractive business case and an interesting risk/return structure still have good chances. Successful launches require appropriate market momentum, expertise and clear investor communication. The Corporate Finance & Capital Markets team of the Swiss Finance & Property Group (SFP) is currently supporting the launch of club deals and an “evergreen” investment vehicle in the area of property development.

Need for refurbishment of investment properties and shortage of supply in residential property as market drivers for successful launch

The market environment for investment properties has changed since the beginning of 2022. This is partly due to the interest rate environment and the increasing focus of institutional investors and financing banks on ESG criteria. The former are now focusing on sustainably constructed residential properties in central locations. At the same time, properties that no longer fit into the investment strategy are being sold. This is currently reflected in an oversupply in the segment of older properties in need of refurbishment.

Average residential property prices in Switzerland are seemingly unaffected by the rise in interest rates. Although growth has slowed somewhat compared to recent years, the slowdown is primarily evident in the upper price segment / single-family homes.

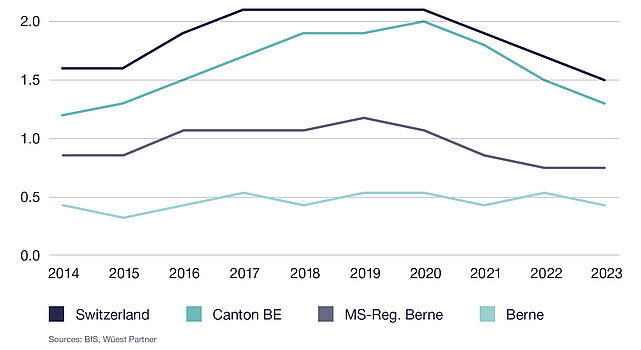

Vacant flats in relation to the existing stock

Supply price index for residential property in Switzerland

If we look at the overall vacancy rate in Switzerland over time, we can see that it has continued to fall. There is a housing shortage in some urban and peri-urban areas in particular. In our opinion, this is a good indicator of the medium-term value of the current average price level for residential property in Switzerland.

Intuitively, the increased demand for housing in Switzerland does not match the decline in construction activity, especially as this was already evident before the interest rate turnaround in 2022. From an economic perspective, it is therefore plausible that there are other factors militating against stronger market entry by investors. In addition to possible uncertainty regarding construction costs, these are certainly the increased demands on construction personnel, as construction is becoming increasingly dense and only a few projects are being built on greenfield sites. In addition, building objections and complicated and time-consuming procedures are criticised.

Clear focus on value creation and collaboration with an experienced partner

In order to be economically successful in property development, a clear awareness of the individual risk factors is required. On the one hand, the return must compensate for the risks taken, while on the other hand the organisational structures and experience of the team must be in place to manage the corresponding risks. The primary objective must be to generate attractive returns for investors and to achieve sustainable benefits for tenants and society.

For property developments, the Swiss Finance & Property Group works with strategic partners who have the expertise, experience and track record to realise development projects in a targeted manner. In the area of club deals and other property investment vehicles, the selected partner is EROP Generation AG (EROP), whose two founders Andrea Blotti and Manuel Sassella and their team are proven experts in property development.

Support for investment vehicles over the entire life cycle

The Corporate Finance & Capital Market team supports EROP in the launch of the club deals and the “evergreen” investment vehicle. We are involved in the development of the initial idea, the preparation of marketing documents, pre-sounding and approaching investors through to ongoing investor support. As capital market specialists, our focus is on the interests of investors. In doing so, the investment vehicles are consistently aligned with the added value of the investors with state-of-the-art corporate governance, clear financial objectives and performance-related remuneration.

If you are interested in club deals in Switzerland, we look forward to hearing from you.

Contact

![[Translate to Englisch:] [Translate to Englisch:]](/assets/group/_processed_/7/0/csm_AdobeStock_220372535_b6f5e52cb6.jpg)