"Both!" would be the best answer to the question whether investing in the residential or the commercial sector is best. Investments in residential property favour high earnings security over an attractive return. Investments in commercial properties, on the other hand, offer good potential in the current climate of growing demand for commercial space and moderate entry opportunities.

Most institutional investors continue to focus strongly on residential real estate funds. This article uses specific sources to explain why commercial properties support sensible diversification and why an engagement can benefit from higher demand in the medium term. Although this analysis includes properties that are mostly used for offices or retail purposes, the focus falls on properties used for logistics, warehousing, commercial and industrial purposes.

Residential is expensive, logistics and industrial are growing

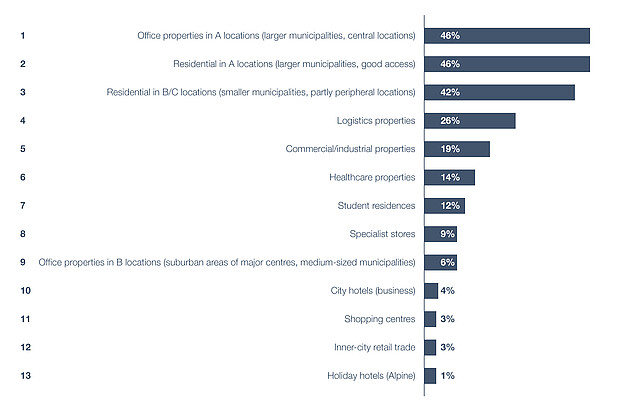

The economy has bounced back strongly after the pandemic1 and growth is expected to continue in 2022 in spite of the current events in Ukraine. Political instability is causing uncertainty on the equity markets and will support safe real estate investments. Investment pressure will remain high. According to a study by JLL2, 97% of investors want to acquire the same volume or more. The preferred asset classes include office properties at top locations and residential properties, followed closely by logistics, commercial and industrial properties.

Wüest Partner3 expects demand for both logistics and industrial space to rise. For logistics, the focus falls on buildings with efficient high racks, huge storehouses and individual small spaces. The industrial sector has recovered and will react to the negative experiences made with non-functioning supply chains during the pandemic by increasing domestic production capacity again. As a result, demand for industrial and commercial space will remain high. The dynamic growth in demand on the logistics market is supported by the booming online trade.

As confirmed by the investor surveys of CSL Immobilien4, investors are very interested in logistics and industrial space. The realisation of large new build projects presents a great challenge for many investors, not least because of the low availability of suitable land, restrictions under building law and regulatory provisions. Large projects offer a high degree of stability during the fixed contract term, but also present a cluster risk if re-letting becomes necessary. Third-party use therefore plays an important role in the assessment. In contrast, properties with a number of small spaces are less dependent on the economy and exhibit lower volatility. "Portfolios such as that of the SF Commercial Properties Fund with a balanced mix of properties used by one long-term prime tenant and real estate with small spaces suitable for multiple use offer high earnings security and low risk," says Hans-Peter Wasser, Portfolio Manager Real Estate Direct at Swiss Finance & Property Funds Ltd.

Commercial properties offer lucrative opportunities

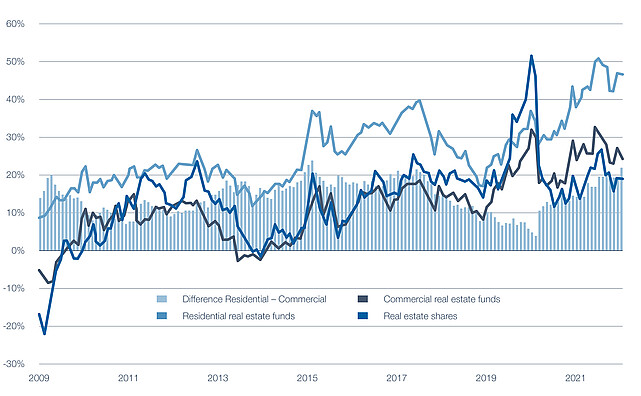

According to the latest studies, commercial and logistics properties are still underestimated in Switzerland. Although commercial properties offer good opportunities for attractive returns, investors continue to prefer residential properties. As they are willing to pay a high price for residential real estate funds, premiums amount to around 40% while distribution yields are only 2.1% on average.5

Commercial real estate funds, on the other hand, post average distribution yields of 3.4%6. A number of vehicles focusing on properties used for commercial purposes report considerably higher yields. Given the tight supply and difficult and time-consuming processes for realising new logistics builds, funds that already have an existing portfolio of commercial properties are particularly attractive. As it is relatively easy to adjust commercial rental contracts to changes in the consumer price index, these investments offer good protection against rising inflation, which cannot be said of residential properties. From the investor's point of view, it is certainly worth considering using part of the gains earned in the residential sector to strengthen the exposure to commercial properties.

1 Credit Suisse, Swiss Real Estate Market in 2022, Zurich, March 2022

2 Jones Lang Lasalle, Swiss Real Estate Transaction Market – Outlook 2022, Zurich, 01/04/2022

3 Wüest Partner AG, Immo-Monitoring 2022|1, Zurich

4 CSL Immobilien, Property Market Report 2022, Zurich

5 Credit Suisse, Swiss real estate market in 2022, Zurich, March 2022

6 Credit Suisse, Swiss real estate market in 2022, Zurich, March 2022