A few weeks ago, as the flames ceased their dance upon the timbers of Copenhagen’s historic stock exchange. The iconic 400-year-old building, the symbol of Copenhagen's financial history, helped to thrust a very interesting real estate market into the spotlight. For several years now, a smouldering energy has been building within the city, not a destructive inferno, but rather a fervent surge in the real estate market. The city’s property sector blazed with activity, harnessing the intensity of this fire and directing it toward robust growth and prosperity. In this context, we delve into why this development holds significance for both Swiss and international investors.

The Copenhagen residential real estate market is characterised by high demand and undersupply, resulting in upward pressure on rental levels, where we have observed growth rates above inflation in the past ten years. There is increased demand for rental units, and slowing supply is expected to enhance this trend. High inflation and increasing interest rates are reflected in the Copenhagen residential market yields, which have increased by ~100 bps since peak in Q1 2022. With a decelerating yield development and a more stable economic environment, the yields are expected to have stabilised.

But why should a Swiss investor think of Copenhagen, when they have the option of investing in their home market? Overall, Swiss real estate is considered a stable investment opportunity with a strong currency and a business-friendly economy. Switzerland has the highest innovation rate and highest GDP per capita in the world, as well as lower inflation rates compared to Europe. Due to high regulatory pressure, building activities have diminished in the urban residential areas of Switzerland, and transactions have been relatively scarce in the last three quarters, as there was a big gap between the buyers’ and the sellers’ price expectations.

Value Drivers of Copenhagen Residential

While Copenhagen’s residential real estate market has, similar to many cities in Switzerland, a ‘safe haven’ status and accumulated an undersupply of real estate stock, the inflation rate is with 0.8% below the European average and even lower than the inflation rate in Switzerland. The current transactional situation in Denmark is characterised by motivated sellers, as i) international investors with activities in Denmark may have the need to gain short-term liquidity or de-risk due to home market challenges (for example in Germany and Sweden with an imminent refinancing challenge and where the markets are far more cyclical than in Denmark, and Sweden doesn’t have the luxury of having a currency pegged to the EUR) and ii) developers with increased equity requirements due to refinancing gap upon project completion or developers looking for forward funding/commitment to finalise initiated projects. On top of that, Denmark provides a unique mortgage bond model with cheap and flexible financing.

Focus on sustainability

Copenhagen is one of very few magnet cities in Europe with a strong concentration of the country’s population in the capital. A continuously strong economic growth (several large global companies have their headquarters based in Copenhagen, strong shipping industry and pharmaceutical sector best exemplified by Mærsk and Novo Nordisk, respectively) favours population growth and an increased number of skilled labour flocking into Copenhagen, which results in a favourable supply/demand balance in the city. But not only very strong economic factors speak for investing in Copenhagen: the Danish capital aims to become the world’s first carbon-neutral city by 2025. Today, Copenhagen’s residential real estate is fully connected to the heating grid, which is already 85% carbon neutral.

Outlook: High expected rent growth and therefore higher net returns

Four main value drivers support high rent growth in Copenhagen:

Accumulated residential undersupply (figure 1):

Copenhagen has seen a substantial accumulated undersupply in the past ten years due to high population growth and inadequate supply of residential housing. Colliers estimates an accumulated undersupply of approx. 500 000 residential square meters since 2012.

Residential construction ‘stop’:

Due to a combination of increased construction costs and high residential market yields in Copenhagen, the forward premium on residential real estate projects has been squeezed. This will inevitably result in a significant reduction in planned residential projects in coming years, which will enhance the accumulated undersupply and put an upward pressure on rent levels.

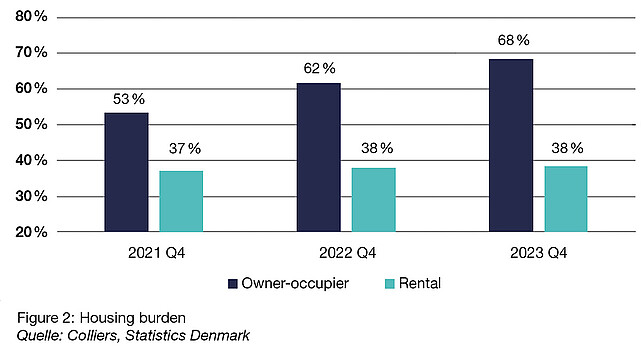

Increased relative attractiveness of rental housing (figure 2):

The increase in interest rates has made rental housing relatively more attractive compared to home ownership, which shifts the demand towards rental properties. As the interest rates are not expected to return to the previous ‘zero-environment’, the recent shift in demand can only be absorbed by a significant reduction in housing prices in the private market which is not likely to happen based on recent data points.

Real wage growth:

As the government imposed a ceiling on rental regulations of 4% in Denmark, the high inflation rates of 2022 (8.7%) was not fully imposed on the consumers. As we expect the purchase power to be regained in coming years through abnormal wage growth this should put an upward pressure on rental levels. IDA (Danish Society of Engineers) reports a nominal wage growth of 6.5% in 2023 and forecast a wage growth of 7.0% in 2024.

Combining the identified value drivers above, we deem it likely that rental growth in the coming years will exceed what has been observed in the past ten years.

Summarising the key investment drivers in Copenhagen

Please note that these are momentous trends, and the real estate market can vary depending on the specific economic and geo-political situation. It’s always a good idea to consult with a local real estate expert when making property decisions.

If you are looking for a strong partner for real estate in Copenhagen, please contact Kristian Vinther from VIGA RE A/S or Michael von Orelli from Swiss Finance & Property Group.

Contact

![[Translate to Englisch:] [Translate to Englisch:]](/assets/group/_processed_/9/9/csm_AdobeStock_464018812_web_d3335520c8.jpg)