The importance of the total expense ratio (TER) when making investment decisions

The total expense ratio (TER) is the most internationally accepted and commonly used cost indicator in asset management. It tells investors what costs are incurred each year by each product and includes the management, administration, custody and additional service fees. The TERs reported by investment products therefore play an increasingly important role in the analysis and selection of investment products, alongside other indicators such as the distribution yield, price performance and investment yield. This leads to "expensive" products that do not generate a risk-adjusted surplus yield in comparison to a benchmark being punished fairly quickly by investors and underweighted in subsequent rebalancing measures.

Efforts to standardise the reporting of indicators

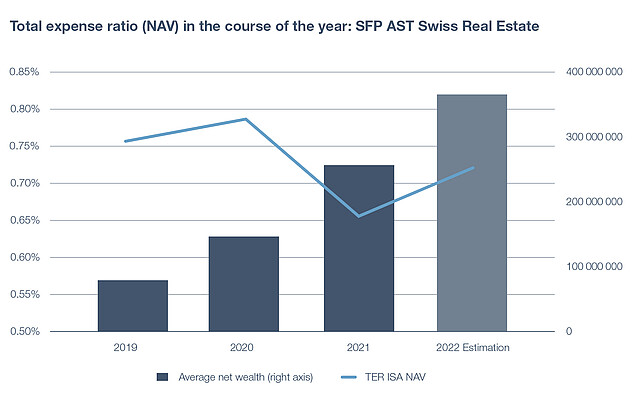

In the past, these TER indicators were often reported differently by the products, which prompted the Asset Management Association Switzerland (AMAS) to publish a guideline for real estate funds in 2008. For direct real estate investments made by investment foundations, the Investment Foundation Directors' Conference (KGAST) followed this by publishing KGAST Guideline No.1 that gives a precise definition of all indicators used by investment foundations' special real estate funds (ISAs). The TERISA (total expense ratio for investment foundations' special real estate funds) is based on the TERREF (TER real estate funds) and indicates the extent to which a real estate investment group is burdened by operating expenses. This burden can be compared to the volume of both total assets (GAV: Gross Asset Value) and net assets (NAV: Net Asset Value).

These instructions led to standardised reporting by real estate funds and investment foundations with investment groups that hold direct investments in real estate, thus facilitating direct comparisons between these products.

The TER of direct real estate investments differs from that of other investment products because it has to be calculated taking the costs of property management (which is often carried out by a third-party provider) into account. The transactions costs incurred when buying and selling investments have no bearing on the TER. These form part of the initial costs of the investments and are included in the realised capital gains or losses when they are sold. According to the prevailing opinion, the due diligence expenses incurred for transactions that were investigated but never carried out are also not considered part of an investment group's operating expenses. The amount of these expenses can vary depending on the product in question's growth profile or ambitions.

Improved efficiency and economies of scale for larger real estate funds

As a portion of the administrative costs (that should not be underestimated) does not increase in proportion to the volume of real estate assets under management, a larger special real estate fund allows for a lower cost ratio because largely fixed costs such as accounting, marketing, foundation board fees and bank charges are similar for both smaller and larger investment groups. It is therefore not surprising that investment foundations with very large real estate funds in particular report lower cost ratios than their smaller competitors as they benefit the most from improvements in efficiency and economies of scale.

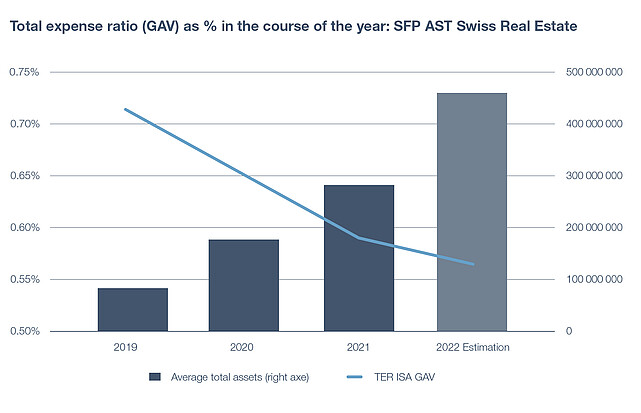

The Swiss Real Estate investment group of the SFP Investment Foundation also benefits from this improvement in efficiency, with a cost ratio based on the total volume of assets under management (TER ISA GAV) that decreased from 0.91% in 2019 to 0.65% in 2021. The investment group has also once again experienced strong growth this financial year, which should allow the total expense ratio to be reduced by another 5 or 6 basis points to below 0.60%.

It should be noted, however, that the cost factor is just one element of performance among many, although it has increasingly come to the fore in recent years (and rightly so for many pension funds) due the compression of yields that has been observed. Investors should therefore in particular consider the potential income based on the current valuation when making investment decisions. The factors that need to be taken into account include the continuous exploitation of potential rents as well as increases due to cost-effective renovations and any replacement new builds. The SFP Investment Foundation's portfolio also offers an extremely good risk/return profile in this respect.

Conclusion

Analysing the administration costs of various different investment products can offer investors a better foundation for making their investment decisions from a cost perspective.