Swiss Finance & Property Ltd supports the first Swiss IPO of 2022 in an extremely challenging market environment

The Corporate Finance & Banking team of Swiss Finance & Property Ltd ("SFP"), which has been a licensed securities firm for about a year now, assisted EPIC Suisse AG ("EPIC") with its IPO. Despite challenging market conditions, the biggest real estate IPO on the Swiss stock market for eight years was a success thanks to painstaking preparation.

Volatility – COVID-19 is old news

Volatility on the stock market has increased sharply again since the start of 2022. Although many countries have lifted the restrictions introduced in response to COVID-19, the skittishness on the market is unsurprising given the general economic conditions, with factors such as persistently high inflation, geopolitical uncertainty as a result of the invasion of Ukraine and signs that key interest rates will be increased all unsettling investors. The Cboe Volatility Index, or "VIX" (also known as the "Fear Index"), has already climbed above 30 several times since the start of the year, which underscores the high levels of volatility on the stock markets.

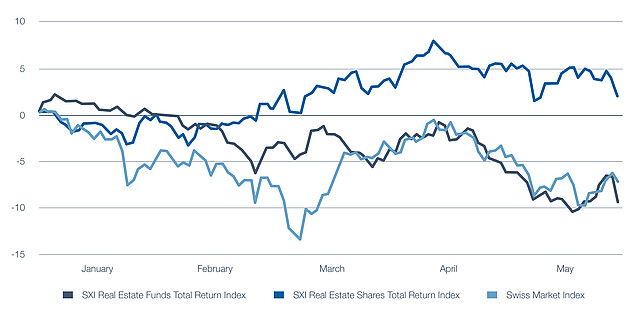

Stock market sentiment has been poor for several months now, as illustrated by the declines in the SMI (-9.82%*), S&P 500 (-13.53%*) and MSCI World Index (-13.78%*). Consolidation has also been observed among Swiss real estate funds, due in particular to rising interest rates. This has caused the SXI Real Estate Funds Broad Index (SWIIT Index), for example, to decrease by 9.44%* since the start of 2022. Real estate stocks have proven to be comparatively crisis-resistant since the start of the year. The SXI Real Estate Shares Broad Index (REAL Index), for example, increased by 1.89% up to the end of May 2022 YTD.

*Reference date: 31 May 2022

Performance of the SMI, SWIIT and REAL, 1 January 2022 – 31 May 2022

Challenging market conditions have led to a global slump in the IPO market. Many companies are postponing previously announced IPOs, and the global volume of IPOs in the first quarter of 2022 was significantly lower than for the same period in the previous year. In Switzerland, only two companies have taken the step of listing at the SIX Swiss Exchange until mid-May 2022, albeit without raising capital at the same time. EPIC has shown strength during these turbulent times. Given the fact that the company was forced to break off its planned IPO in autumn 2020 at short notice, there was huge pressure on all involved to make a success of it this time around. Although conditions on the market deteriorated continuously while the transaction parties was being prepared, the company stuck to its plans and consistently pursued into the market.

Successful IPO thanks to careful preparation

The meticulous preparation of the IPO paid off in the end. The IPO is set to generate a gross inflow of CHF 183 million for the company (before the exercise of the greenshoe option). Among other things, the IPO will allow the company to push forward with its growth at a faster pace, secure its access to the capital market in the long term and raise its profile on the market.

SFP's Corporate Finance & Banking team supported the IPO at every stage as co-manager, together with the teams from Credit Suisse's Investment Banking division and Zürcher Kantonalbank as Joint Global Coordinators. The first phase involved developing the investment case, after feedback was obtained from investors on a confidential basis. In this way, investors' assessments were used to arrive at the best possible structure for the transaction. EPIC also organised a large number of property tours in order to give potential investors an in-depth impression of the portfolio and the exciting development projects. EPIC's management spared no effort during the transaction and attached great value to personal dialogue with potential investors. An extraordinarily high conversion rate underscored the high importance of this approach for the success of the transaction.

Robust business model, appealing dividend, protection against inflation and potential for increased value

Here are some of the success factors underlying EPIC's investment case:

- High-quality portfolio and stable operating cash flow: Since its launch, the company has built up a high-quality portfolio comprising 25 properties with a total market value in the region of CHF 1.5 billion (as at the end of 2021). The focus is on office, retail, commercial and logistics/industrial properties. One important selling point is the strong tenant base with long-term leases, 87% of which are tied to inflation. The business model has proved itself to be robust in recent years in particular, with rental income increasing despite COVID-19.

-

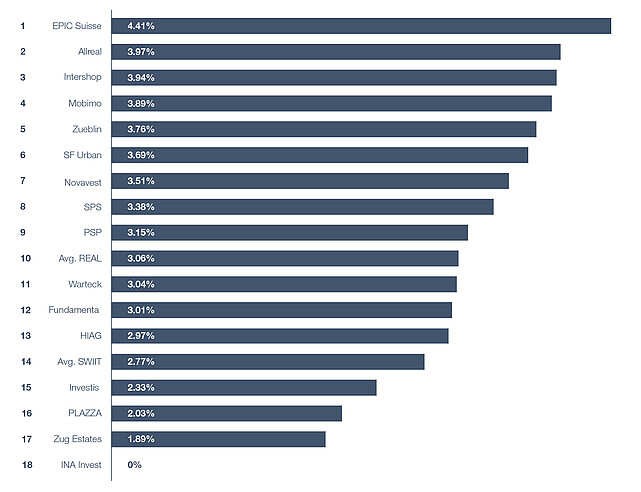

Appealing dividend: EPIC stands out on account of its appealing dividend policy. After paying out a fixed dividend of CHF 3.00 per share for the 2022 financial year, the company is hoping to distribute 80% of its funds from operations (FFO). The foreign capital contribution reserves amounting to CHF 279.1 million at the end of 2021, which offer potential for dividends that are free from withholding tax and income tax for residents of Switzerland, are particularly appealing. Based on an issue price of CHF 68.00 per share, a dividend of CHF 3.00 results in a dividend yield of 4.4%. This gives EPIC one of the highest distribution yields among Swiss real estate stocks.

- Development opportunities: Pipeline projects with a volume of around CHF 500 million over the next ten years have already been identified with regard to adjacent plots and properties. EPIC is following a "value-added" strategy in this respect and seeking to achieve a yield on cost of over 5%.

Comparison of dividend yields at the time of listing*

Another milestone for SFP's Corporate Finance & Banking team

The successful completion of this transaction represents another milestone for SFP. It was only at the start of 2021 that SFP increased the range of services it offers in the field of securities issuing as a result of its licensing as a securities firm by FINMA, the Swiss Financial Market Supervisory Authority. This makes it all the more encouraging that the Corporate Finance & Banking team has now been given the opportunity to demonstrate its many years of experience in the capital markets as a co-manager in this IPO transaction.

The high level of volatility and the challenging market conditions called for a significant degree of flexibility and the ability to respond quickly to sudden changes. Thanks to its proven proximity to the market and long-standing connections with Swiss institutional investors, SFP was able to make an important contribution to the success of the transaction. SFP's Corporate Finance & Banking team brings together experts in their field as part of an established and effective group. As a leading provider of real estate finance services, this puts SFP in an ideal position to support complex capital market transactions.

The good partnership with Credit Suisse and Zürcher Kantonalbank was crucial to the success of the transaction. As a real estate specialist that is independent of any bank, SFP complemented the two major banks well as part of the syndicate. We can only hope that EPIC's IPO will breathe new life into the Swiss transaction and IPO market. A bit of a boost is likely to be most welcome given the current situation on the market.