This article looks at figures relating to Zurich's market for office space based on an analysis and evaluation of data from the City of Zurich's Statistics Office.

The amount of office and medical practice space in the city of Zurich that was reported vacant in 2021 came to around 103,600 m², which is 1.58% of the total available stock. This vacancy rate seems low, but it relates exclusively to the city districts of Zurich. It therefore does not take less central, outlying districts with higher vacancy rates, such as the Glattpark development region, into account. To provide some perspective, the city of Geneva's vacancy rate for office space in 2021 amounted to more than 3%.

The rate at which new urban space is being added is slowing. While the amount of office and medical practice space in the city of Zurich increased by 3.7% between 2013 and 2017, it rose by just 1.2% from 2017 to 2021. During the last eight years, 2020 was the only year in which the amount of office space shrank (by 0.9%). The absolute amount of space available already grew again by 1.1% in 2021.

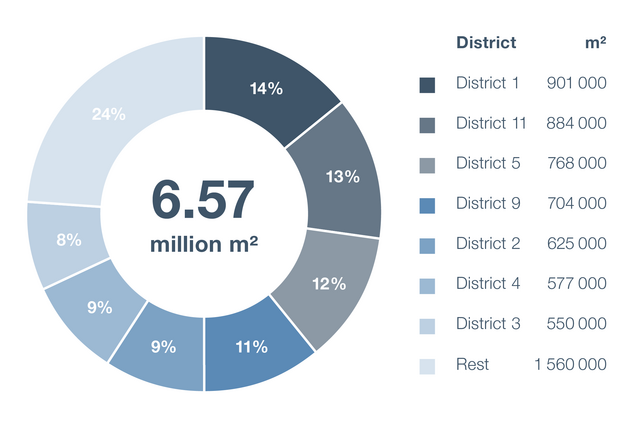

A total of 6.57 million m2 of office and medical practice space in the city of Zurich is available to 467,000 tertiary-sector employees (according to employment figures). This is an average of around 14 m² per person (including prorated circulation space). Almost 50% or 3.26 million m² of the available stock can be found in the four largest districts, which are 1 (City), 5 (Industrie), 9 (Altstetten) and 11 (Oerlikon). Districts 2 (Enge), 3 (Wiedikon) and 4 (Aussersihl) are also traditional office locations but only account for less than 10% of the total office space each. The other five districts each have 500,000 m² of office space or less.

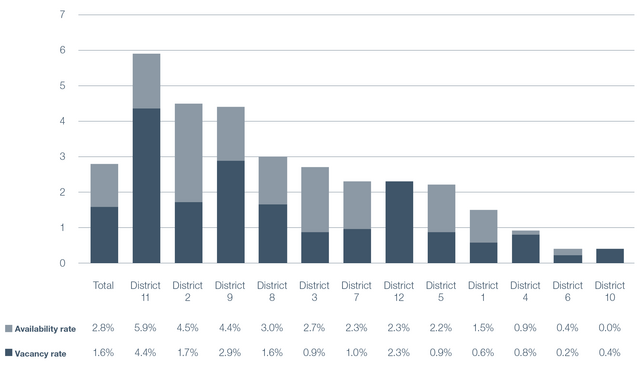

It is interesting to compare the vacancy and availability rates for the different districts. The vacancy rate comprises all spaces reported as vacant at the time of the survey, based on the figures published by the City of Zurich Statistics Office. The availability rate, on the other hand, describes the share of space that is being advertised on the market. Availability rates are always higher than vacancy rates because they include spaces for which notice has been given but have not yet been vacated. That is why the figure below shows the official vacancy rate as per the City of Zurich Statistics Office alongside the availability rate calculated by real estate consultants JLL. District 11 in particular is currently a tenant's market as Oerlikon has the highest vacancy rate, and there is a danger that the rate will continue to grow if absorption is unable to keep up with supply. The trend for districts 2, 3 and 5 is also interesting because a lot of spaces are being advertised despite the fact that the vacancy rate is relatively low. These are robust submarkets for office space, and the author expects the majority of those spaces to be absorbed.

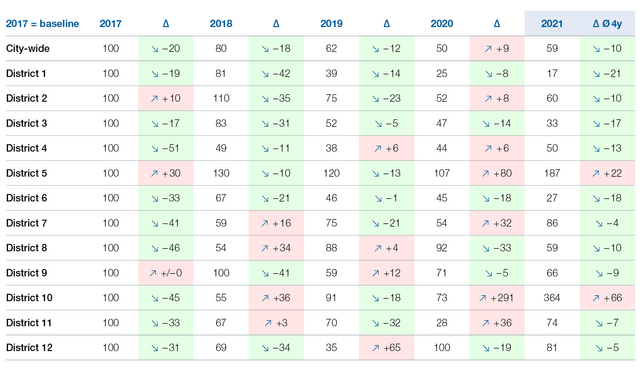

We conclude by analysing a long-term comparison of the percentage change in vacancy rates for the various districts. The idea for this illustration came as a result of considering the best way to show the potential effects of the pandemic. Setting 2017 as the benchmark makes it easier to compare and maintain an overview of the percentage changes in the vacancy rates of the various districts over time. In 2021, the vacancy rate for the entire city of Zurich was 41% lower than in 2017. This means that the vacancy rate for office space fell by more than 10% on average each year. The only increase in the vacancy rate for urban office space was observed between 2020 and 2021. The different districts experienced different trends over the five-year period. Remarkably, district 1's vacancy rate for 2021 is just 17% of what it was in 2017, and even fell during the pandemic. The same applies to districts 1, 3 and 6, all of which also experienced positive trends. It is also apparent that most districts are now doing much better in terms of vacancy than they were in 2017. Only districts 5 and 10 had higher vacancy rates in 2021 than they did four years ago. The outlier is district 10 (Höngg), which, with 263,000 m² of office space (only district 12 has less) and a low vacancy rate, is more sensitive to minor movements in the market. Districts 5, 7, 10 and 11 fared worse during the pandemic, at least in terms of their office vacancy rates. However, a negative trend from one year to the next does not indicate any lasting negative trend for the office submarket. It also often relates to larger buildings that had previously been used by a single tenant and need to be transformed into mixed-use properties after they move out. This puts a lot of space onto the market that needs to be absorbed at the same time.

Most local real estate marketing and consultancy experts agree that the city of Zurich's market for office space is intact despite the crisis. The picture outside the city limits is a different one. According to real estate consultants JLL, another 200,000 m2 of new office space is to be built in the Zurich region in the next two years, even though the municipality of Opfikon/Glattbrugg (Glattpark), for example, already has an availability rate of around 35%. The company therefore expects finding tenants in these locations outside Zurich, which include the municipalities of Kloten, Wallisellen and Schlieren, to remain challenging.

Generally speaking, letting office space anywhere was difficult during the two lockdowns in spring 2020 and spring 2021. Official restrictions on the use of offices (recommendations and requirements to work from home) put a brief halt to enquiries. Potential new tenants were unforthcoming, and companies stopped or postponed their searches for space. The darkest predictions regarding the end of the office did not, however, come to pass. Companies who announced at the start of the pandemic that they intended to do without physical offices completely in the future ultimately returned. Nevertheless, the pandemic will have a lasting impact on the office market and lead to consolidation. In the long term, a hybrid working arrangement will become established that combines both going into the office and working from home. This is because there are benefits and drawbacks to both ways of working, as people who have worked from home for almost two years are now very aware.